How to Maximize the Depreciation Tax Deduction

on your Real Estate Investment

As tax-filing season approaches, real estate investors get to face one of the ultimate “high-level” problems — deciding how much depreciation to write off. Most real estate investors are using straight 27.5 year depreciation on their real estate investment. In this article I explain how to lower taxes with accelerated depreciation and bonus depreciation.

We dig into how cool depreciation is in this blog, but to sum up — depreciation, i.e. wear and tear of the property, is an “expense” that real estate investors get to declare on their taxes without having to spend money out of pocket … even if the property has gone up in value despite the wear and tear!

It’s easy to see why this is awesome … but it can get even more awesome. The IRS says residential real estate can be depreciated over 27.5 years, maximum. Most investors — and, in fact, most tax accountants — just take that at face value. They divide the cost basis of the improvements by 27.5, and deduct that much every year. There’s nothing wrong with this … It’s certainly better than a kick in the pants.

But what if you could deduct even more appreciation … or deduct more, sooner? Creative real estate investors and tax accountants can make that happen, while still adhering to the rules set by the IRS.

Lower Taxes With Accelerated Depreciation

Let’s look at two ways we can legally take more depreciation than the standard 27.5-year rule:

1. Filing as a real estate professional

2. Accelerated depreciation through cost-segregation, aka “component” depreciation

NOTE: We are not lawyers, CPAs, or financial advisors. Consult professionals before trying anything you read here.

1. Filing as a Real Estate Professional

Most real estate investors are effectively capped at how much ordinary income they can offset with a depreciation deduction. As of this writing, it’s roughly $25,000. If you try to depreciate more than that, the IRS won’t let you.

But there’s an exception — if you qualify as a real estate professional under IRS rules, you can deduct 100% of your depreciation allowance from your ordinary income, without the cap that typical investors face.

To qualify as a real estate professional, you must spend at least 750 hours each year in the real estate business. For most people with full-time jobs, this isn’t realistic … but if your depreciation allowance exceeds the cap, it’s worth checking with your CPA to see if you can thread that needle.

Of course, you will need to own a lot of rental property to hit that cap … unless you use the second method to increase how much depreciation you are allowed to take from each property.

1. Accelerated Depreciation through Cost-Segregation

That’s a mouthful, right? But it’s actually simple — while real estate improvements (i.e. buildings and structures) must be depreciated on a 27.5-year schedule, certain components on the property may be eligible for faster depreciation schedules.

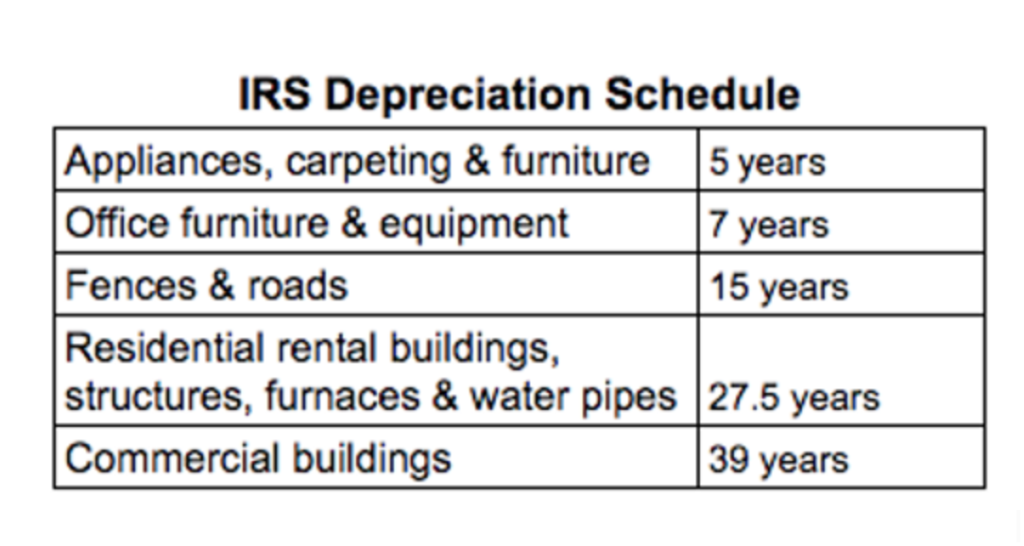

Here’s the full chart of IRS-approved depreciation schedules:

See it? Even humble rental houses have fences, appliances, carpeting, furniture, etc. … and the IRS allows you to depreciate those assets faster than the structure!

Using this chart to take more depreciation than the 27.5-year schedule is called accelerated depreciation. It’s also sometimes called “component” depreciation since you’re breaking the property down to “components” and using the appropriate depreciation schedule for each.

How do you figure out the asset value of each component? Through a process called cost-segregation — taking inventory of everything on the property eligible for accelerated depreciation, determining how much value it contributes to the property, and depreciating that amount separate from the structure.

Example of Accelerated Depreciation

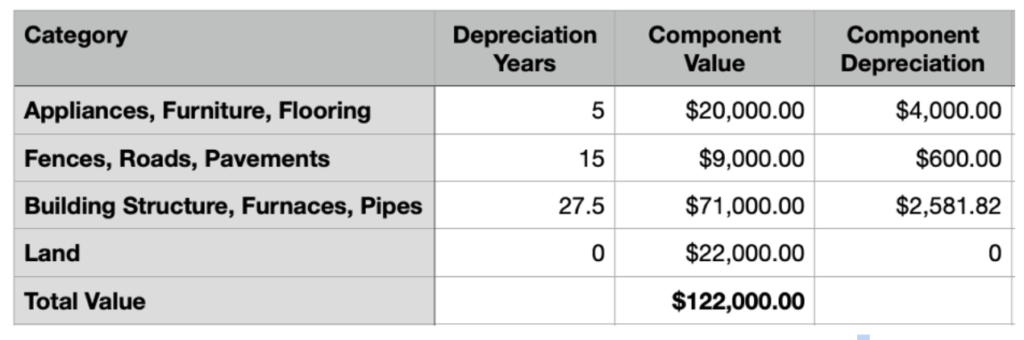

Let’s do a quick example. Say you bought a rental house for $122,000 in a city like Detroit (one of our favorites right now). The appraisal values the land at $22,000. You can’t depreciate land, so that’s a $100,000 cost basis eligible for depreciation.

If you’re doing basic 27.5-year depreciation, you can deduct about $3,600 per year for this house.

But, let’s say you break down the components of the house, and find out that you are eligible for some component depreciation:

The total depreciation you can take for the first five years is now $7,181.82 — nearly double the eligible depreciation under the standard schedule!

Of course, after five years the appliances, furniture, and flooring are fully depreciated, so you no longer get to take that extra $4,000 each year. After 15 years, that extra $600 will fall off as well. But many real estate investors don’t keep their assets for 15 years, or even five years — they sell and upgrade to something bigger and better. But in the meantime, they get to take all that extra depreciation up front!

———————————————————————————————————

Historically, accelerated depreciation has been the province of commercial real estate. Why? Because it requires a professional cost-segregation analysis to avoid trouble with the IRS. These analyses are not cheap, and the tax savings for a single-family home rarely justifies this cost. Only big, multimillion-dollar properties justify the cost.

But, MartelTurnkey likes to stay on the cutting edge. We know how to make cost segregation affordable — even for small-portfolio landlords of single-family homes!

If you want to incorporate accelerated depreciation into your SFR investing strategy as early as this year, you know what to do … Call MartelTurnkey today!