Happy Holidays from your friends at MartelTurnkey! You’re probably getting ready to travel, visit loved ones, eat amazing food, enjoy sparkling lights and winter wonderlands, and send 2022 out with a bang in preparation for a prosperous 2023. Real estate investment might seem a little far away from the spirit of the holidays, but our status as real estate investors colors almost everything we do. On that note, please join us in some real estate investment reflections for the holidays …

1. The Importance of Gratitude

It’s easy to get hypnotized by the hustle and bustle. We humans are problem-solvers, so we have a natural tendency to focus on problems. And in doing so, we tend to forget the ways in which we are lucky.

There’s a reason every society and religion has holidays — they help us focus on our blessings, rather than constantly fretting over our deficiencies. The holidays are the perfect time to practice gratitude. Gratitude lets us take nourishment from the bounty in our lives … and make room in our lives and our hearts for even more bounty.

Real estate investors have many reasons to be grateful. We listed 5 reasons real estate investors have to be thankful in our Thanksgiving blog if you want to revisit them. Here they are in brief:

- Passive Cash Flow

- Appreciation of Value

- Debt Leverage

- Principal Paydown

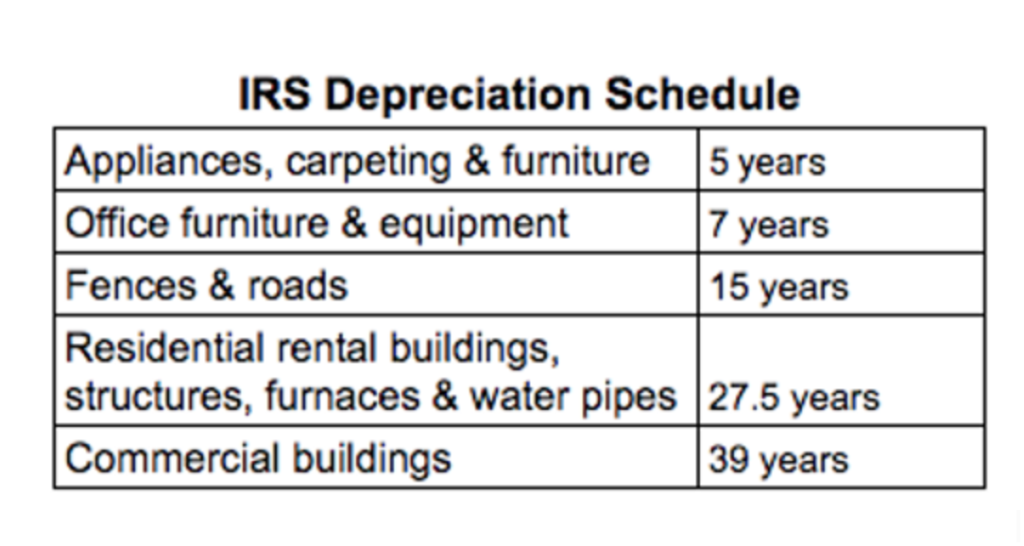

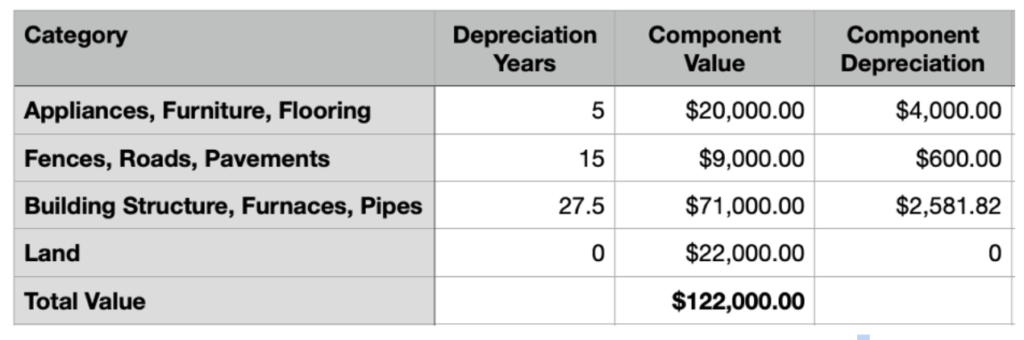

- Tax Advantages

2. Helping People

In addition to counting our blessings, the holidays are a time to step outside of ourselves and think about others — especially those less fortunate than us. It’s a time of charity, altruism, and (as the song goes) “good will towards men.” And women, and children.

Many people believe real estate investors are money-grubbing Ebenezer Scrooges. Sometimes it’s easy to get seduced by the dollar signs.

But real estate investors who are in it for the long term … we know the truth. It’s not about a quick buck. It’s about improving lives.

We like the way Zero Gravity CEO Peter Diamandis put it — “The best way to become a billionaire is to help a billion people.” People who succeed in any business long-term do it by helping people.

Real estate investment is no exception. We turn bare ground into useful structures so people can start businesses and live better lives. We turn decrepit, substandard housing into beautiful homes. We turn crumbling, forlorn neighborhoods into thriving communities.

The spirit of the holidays helps us think not about how much money we have made and expect to make … but about how many people we have helped, and hope to help in the future.

3. The Importance of Family

We’re nothing without the people we love and care for; the people who love and care about us. If we had any holiday wish for anyone, it would be to strengthen bonds, mend fences, and spend quality time with our closest kin.

Real estate investment is ultimately about legacy. We dig deep into that concept in this blog. Suffice it to say, it’s about building something that will last … Something that will edify and enrich your successors for generations to come.

—————————————————————————————————————

Again, best wishes for a happy holiday from the entire MartelTurnkey family! If you want to hit the ground running in the New Year with some brand-new assets in your portfolio, it’s not too late … in fact, we’re just getting started. Drop us a line now and let’s get you your next turnkey rental!