A Tale of Two Investors (Apple vs Real Estate) Part 2 of 3

Welcome to part 2 of A Tale of Two Investors (Apple vs Real Estate). If you didn’t read part 1 please click here.

Part 1 ends in December 2000, Mr. McIntosh benefited from a stock split back in June, while Mr. Moore reinvested his passive income and acquired additional properties. The table shows the equity difference between our two investors.

At the end of 2000

Only a few months after their meeting, Mr. McIntosh’s financial picture has changed significantly. The stock market crash of 2000 saw Apple stock price go down to $14.80 by the end of December. Mr. McIntosh’s equity goes from $48,611 to $12,935 which is significantly lower than what it was in 1987. This is a significant blow to Mr McIntosh finances. He doesn’t have too many choices, he could sell and realize a loss, invest more but he doesn’t have the money. For the purpose of our story, he continues to hold on. Many investors moved out of the stock market and headed for bonds or Real Estate.

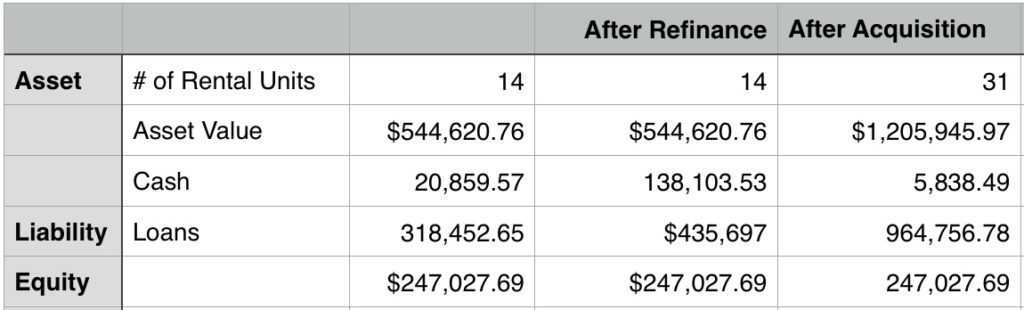

Mr Moore on the other hand is unaffected by the crash and decides to take advantage of the low mortgage rate to refinance his rental units and use the cash to acquire additional rental units. Mr Moore can get a loan for about $435kk (80% of $544,620). The net proceeds of the loan would be about $117k (435k – existing loan 318k). So Mr Moore now has $138k ($117k plus cash on hand $21k) to acquire additional rental units. The current price of the units are about $39,000. Mr Moore needs to put a down payment of $7,780 for each rental unit. Since Mr Moore has $138k cash he can purchase 17 rental units! At the end of the transaction Mr Moore’s balance sheet looks something like this.

With this kind of cash flow and considering that he needs $8,300 as down payment, Mr Moore continues to acquire rental units very rapidly. In fact he is accelerating the pace of his acquisitions.

2001 to 2005

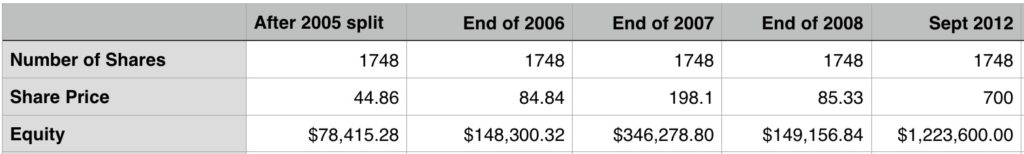

Things are going well for Apple during that time. Apple introduces the iPod in 2001, opens retail stores and iTunes in 2003. On February 28th, 2005, Apple announces a 2 for 1 stock split. The stock closes at 44.86 after the split. Mr McIntosh ’s equity position now looks like this.

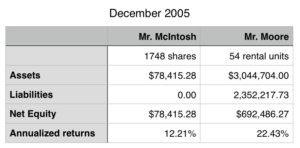

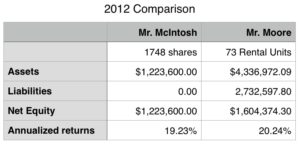

Mr Moore uses his net cash flow to acquire additional rental units. At the end of 2001 his $27k of cash flow allows him to acquire 5 more rental units with a down payment of $41,881. The net cash flow increases every year and by the end of 2005 Mr Moore has 54 rental units in his portfolio with $84k of cash on hand and a net cash flow of almost $60k per year. Below is a table comparing each investor’s equity and their respective annualized returns.

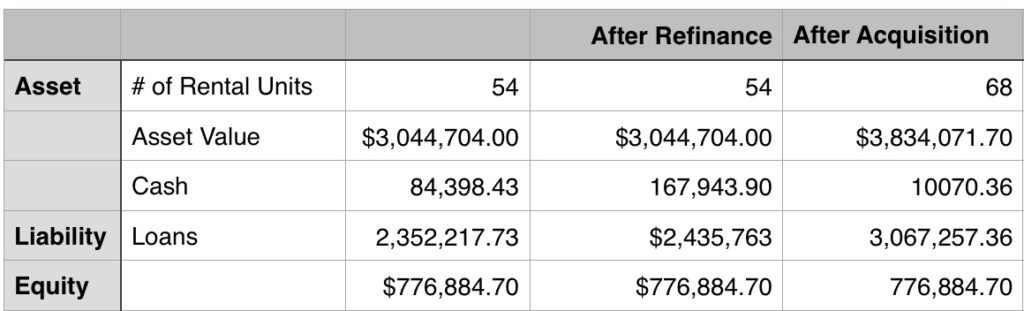

At the end of 2005 Mr Moore decides to refinance and reinvest the cash by acquiring additional rental units. Each rental unit needs about $11,000 in down payment so Mr Moore acquire 14 rental units. The table below outlines his position before refinance, after refinance, and after refinance and acquisition.

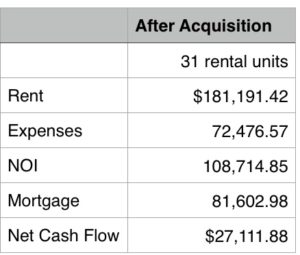

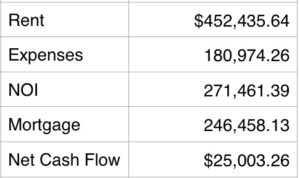

After this acquisition, Mr Moore’s net cash flow is raised to $25k (as shown below).

At the end of 2005, Mr Moore continues to reinvest in his business. He uses the $10k in cash left after the acquisition in addition to the $25k of cashflow to acquire 5 more rental units.

Financial Crisis 2008

We started seeing the effect of the Financial crisis in 2007 where the real estate values went down by 5.6%. In 2008 the housing value went down by 8.5%. These reductions were the sparks that ignited the financial crisis. The reduction in asset value along with subprime mortgages, Mark-to-Market rule, derivatives valuation, and other factors brought the biggest financial crisis ever seen.

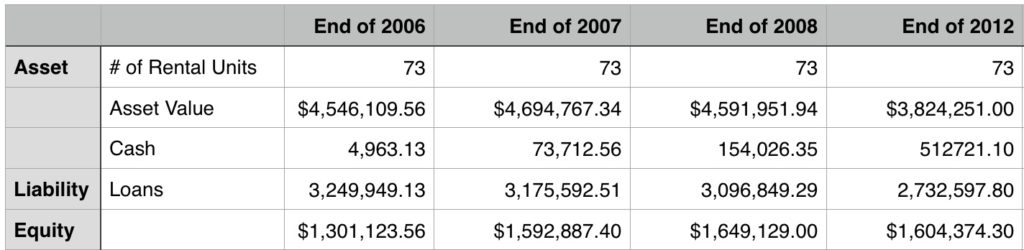

Mr Moore didn’t escape the crisis. The table below illustrates how the Mr Moore’s asset was impacted with the first column showing the balance sheet at the end of 2006 representing the highest asset valuation while the next 2 columns shows how the drop in real estate affected his equity. You will notice that the reduction in equity is dampened by the positive net cashflow and the principal payment on existing mortgage.

Like all investors, Mr Moore is concerned by the events unfolding and he does not acquire additional properties until 2012 when the real estate market started recovering. This very conservative assumption means that Mr Moore will not be able to acquire assets at a lower price. Mr Moore could also use the cash to pay down his loans but he just sits on his cash at 0% interest. Some homeowners seeing their property value underwater decided to stop paying their mortgage, and the banks began widespread foreclosure. This is the impact to Mr. Moore’s equity between 2006 and at the bottom of the market in 2012.

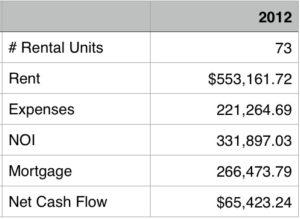

As you can see from the table above, the asset value was reduced by almost 20%. The negative of housing value was dampened by positive net cash flow, and normal reduction in principal from mortgage payment. The tenants renting Mr Moore’s apartments still needed a place to live so the rental income was not affected by the crisis, Mr Moore continued to pay his mortgages even if some of his properties were under water so the bank didn’t foreclose on him. As you can see below Mr Moore is still generating strong positive cashflow.

Mr McIntosh is jubilating at how well Apple stock is doing. Only a few years ago his position was worth $78k and his equity nearly doubled every year in 2006 and 2007. By the end of 2008 however Mr McIntosh saw the value of his portfolio cut in half only to see astronomical growth until 2012. We’ll get to that in the next section.

Conclusion for Part 2

In this article we reviewed the impact of 2 major financial crisis on the equity position of our 2 investors.

Once again it is pretty clear that Mr. McIntosh is at the mercy of the stock market, the economy, the news, the banks, the government, the federal reserves. Mr. Moore is still impacted by the same entities but has more flexibility to protect his assets or take advantage of an opportunity.

Please continue reading Part 3

Great follow-up article Eric! I’m eager to read part 3.