Multifamily syndication is all the rage in real estate investor circles. If you’re unfamiliar, this is when a group of investors pools their money to buy a large apartment complex. Most of the money partners are “passive” investors, with a person called the “deal sponsor” or “deal operator” putting together and actively managing the deal. In this article, we will compare Turnkey Rental vs. Multifamily Syndication.

Turnkey rentals are a kind of passive real estate investment. At MartelTurnkey we do the hard part — acquiring the property and renovating it. Your property manager leases it out and handles the day-to-day. All you have to do is wait for the cash flow.

Turnkey Rental vs. Multifamily Syndication

So here we have two passive real estate investment strategies … How do they compare? Which one is better? Let’s compare the two on seven metrics. Spoiler alert — we saved the biggest one for last, so make sure to stick with us to the end.

1. Barrier To Entry

If you intend to finance the purchase with a mortgage (which, as we discuss in this article, you should definitely do) the biggest barrier to entry for turnkey rentals is that you have to personally qualify for the mortgage. This isn’t as hard as it looks, though. If you can qualify for a home mortgage, you can almost certainly qualify for an investment mortgage.

With multifamily syndication, the deal sponsor is usually the one who has to qualify for the commercial mortgage. But this isn’t the only barrier to entry. Many deal sponsors have “minimum investment” thresholds of $50,000 or more. Compare that to MartelTurnkey, with initial investments starting in the low $30k range.

Some multifamily syndications are only open to accredited investors — people with $1 million net worth (excluding their personal residence) and/or gross income of $200,000 or more. This barrier alone means many multifamily syndications are off-limits to a majority of beginner investors.

Advantage: Turnkey Rental

2. Initial Investment

When you buy a turnkey rental, you expect to get a “clean” property. If the sellers were scrupulous with the renovation, you should have no major repairs for years to come. So once you have made the down payment and paid closing costs and fees, that’s it — you’re all in.

Multifamily syndications, on the other hand, tend to buy property that still needs renovation. The initial investment includes a renovation budget. If the renovation goes over budget (which is far from uncommon), the deal operator may have to do a “cash call” — ask the investor group to pitch in more money.

Advantage: Turnkey Rental

3. Compensation for the “Active” Investor

Some people denigrate turnkey rentals because you’re “overpaying” due to the seller’s profit margin. Why not just buy a fixer-upper and do it yourself?

Remember, though, that renovations can go over budget. With a turnkey rental, you’re paying appraised market value for less work and less risk. Whatever our profit margin, MartelTurnkey strives to hand over a property with positive cash flow on day one, so your risk is minimal.

Compare that to a multifamily syndication. The deal operator may take compensation in the form of up-front fees, an ongoing percentage of the rent collected … even a percentage of the deal equity that they didn’t pay for. And remember point #2 — there’s still renovation to be done.

Advantage: Turnkey Rental

4. Return On Investment

When it comes to ROI, the location and the desirability of the property make all the difference, regardless of whether it’s a single-family home or an apartment complex.

Multifamily property has some advantages due to “economies of scale.” Look at it this way — you collect a lot more rent per roof that needs repairing, since eight or more people live under that roof.

Of course, the deal sponsor’s fees could eat into that profit margin. Keep in mind, too, that commercial real estate moves in cycles — multifamily may be popular for a few years, then it may shift to industrial, then retail, and so on.

By contrast, turnkey rentals tend to be single-family homes, which are always in demand and appreciate excellently.

Advantage: Tie

5. Financing

As mentioned above in #1, with multifamily syndications the passive investors usually don’t have to go through the crucible of applying for the mortgage. The deal operator takes care of that. With turnkey rentals, you have to get the mortgage.

Multifamily property may also qualify for “agency” loans from government agencies like Fannie Mae and Freddie Mac, which have attractive terms, including interest-only periods and non-recourse terms.

Advantage: Multifamily Syndication

6. Tax Advantages

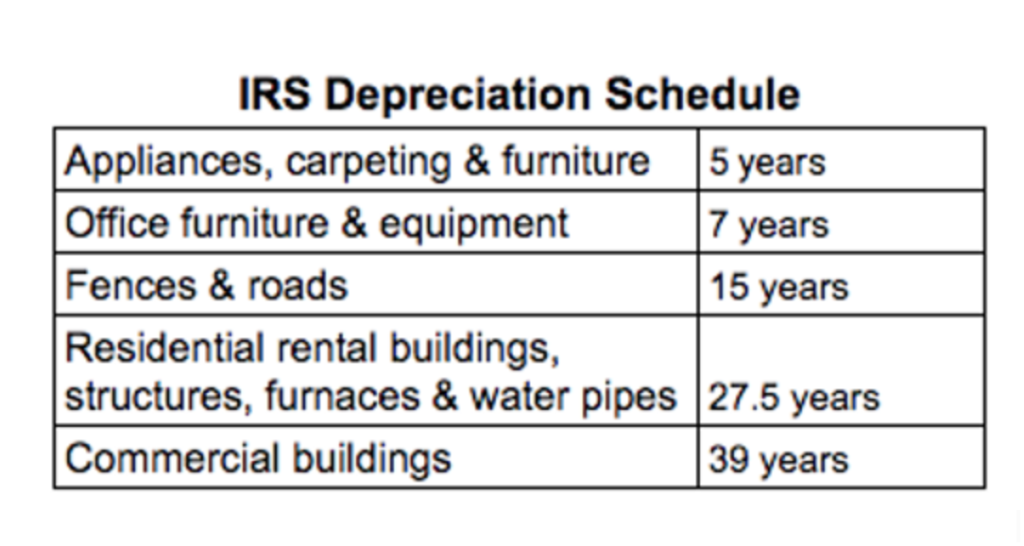

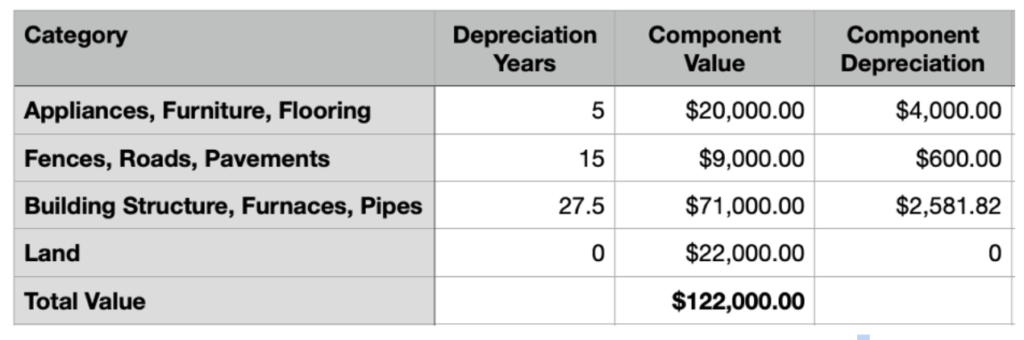

All the same tax advantages that apply to multifamily property apply to single-family property.

According to most real estate thought leaders, multifamily has a big advantage — it’s more cost-effective to take accelerated depreciation on an apartment complex than on a single-family home.

However, in this article we not only describe what accelerated depreciation is and why it’s so amazing, we also describe how technology has caught up to the point where it may now be cost-effective to take accelerated depreciation on a single-family rental as well.

Advantage: Tie

7. Control Of Your Destiny

One of the biggest advantages of turnkey rentals over multifamily syndications is that you get to call the shots.

When you invest passively in a multifamily syndication, the deal sponsor has all the power. They hire and fire, they set and execute the strategy, they approve repairs and renovations, they decide when to sell or refinance. You have little or no say in any of that. It’s like owning stock in Apple — yes, you might make money, but you don’t get to design the next iPhone.

Worst-case scenario — if the deal sponsor turns out to be negligent or crooked, the passive investors could suffer huge losses before finally wresting control back from the errant deal sponsor.

With a turnkey rental, on the other hand, you’re the boss. Once MartelTurnkey hands over the keys, our clients are free to change strategies, change property managers, sell or refinance at will — no need for permission from anyone. With a turnkey rental, you are truly in the driver’s seat of your own financial destiny.

Advantage: Turnkey Rental

————————————————————————————————————

The winner … turnkey rentals! Maybe not surprising, coming from a company called MartelTurnkey, but we’re pretty confident in our logic. We can also back up our confidence with results. Take a look at our property inventory, and if you’re ready to consider investing, reach out to us today!